Successful business operations depend on the skillful management of budgets. But inaccuracies can happen without the right tools. Many traditional methods involving manual data entry are generic. They can lead to preventable inefficiencies.

By large, users of QuickBooks Online (QBO) are struggling with budget handling. The platform often has limitations when transferring large amounts of data. G-Accon for QuickBooks optimizes this process. This article explores how to simplify your budget imports and save you time.

Having an efficient budget upload system is crucial for any business. It minimizes errors and ensures reliable financial data. In return, financial managers and accountants can dedicate their time to strategic tasks.

Without automation, updating budgets compromises performance. Integrated budget syncs leverage financial planning. They allow the creation, editing, and removal of budgets. Teams can master budget transfers from Google Sheets to QuickBooks with ease.

G-Accon stands out with its bulk budget uploads from Google Sheets to QuickBooks Online. This functionality is designed to streamline your budget management processes. An essential tool for QuickBooks users, G-Accon Budget Uploads is powered by automated workflows. It has arrived with a set of capabilities offering:

Unlike other tools in the marketplace, this integration gets you ahead rather than bogged down. Get to know a feature that provides customization and data consistency.

The setting-up process for Budget Uploads is straightforward. You can design a template, select data, and apply field mapping. It also involved scheduling automatic uploads and uploading data with one click.

To upload your data in QuickBooks, first log into your account. This integration works with QuickBooks Online API functionality. The QuickBooks Online Accounting API uses REST and JSON to send and receive data. It enables apps to access most features used by QuickBooks Online customers.

Get an overview of how to upload your budgets to QuickBooks with up-to-date insights. This is a one-time process:

For a detailed walkthrough, consult the guide to Bulk Uploads in the G-Accon Help Centre. You can also watch a virtual explanation of how to bulk upload budgets to QuickBooks:

Consider automating budgeting workflows into your accounting software. This method promotes up-to-date data with consistent insights.

Bulk Uploads by G-Accon gives you a competitive edge. Using G-Accon bulk budget reporting empowers your budgeting processes. It allows organizations to achieve a higher level of financial control.

Powered by G-Accon automated workflows, this integration offers many features. Check some tips to take advantage of them:

Many QuickBooks users are connecting Google Sheets and QuickBooks with G-Accon. This integration grants easy data transfer between the two platforms. Businesses have great visualization of QuickBooks' imported and exported data.

All these users are already supercharging their budget management process. Do not let sluggish manual data entry hinder your progress. G-Accon for QuickBooks is an indispensable tool providing:

Try G-Accon for QuickBooks today. Enjoy our trial and gain access to smooth budgeting.

Get in touch with us. Don’t forget to email your suggestions at support@accon.services.

This is financial clarity made easy. This is G-Accon.

Reconciling and tracking financial statements from various entities demands precision to avoid discrepancies. Failure to do so results in costly mistakes with serious consequences. But intercompany transactions don’t have to be daunting.

G-Accon for Xero in Google Sheets eliminates these complexities. It automates the generation of consolidated reports. This article will explain the basics of intercompany eliminations and how to use them effectively. Discover how to transform your intercompany reporting with just one click.

Whenever a parent company transfers assets between its affiliates, you get intercompany transactions. These transfers need careful accounting entries and some eliminations.

Eliminating intercompany transactions ensures financial rigor. It’s a procedure that only reflects transactions with external parties. This process has many benefits:

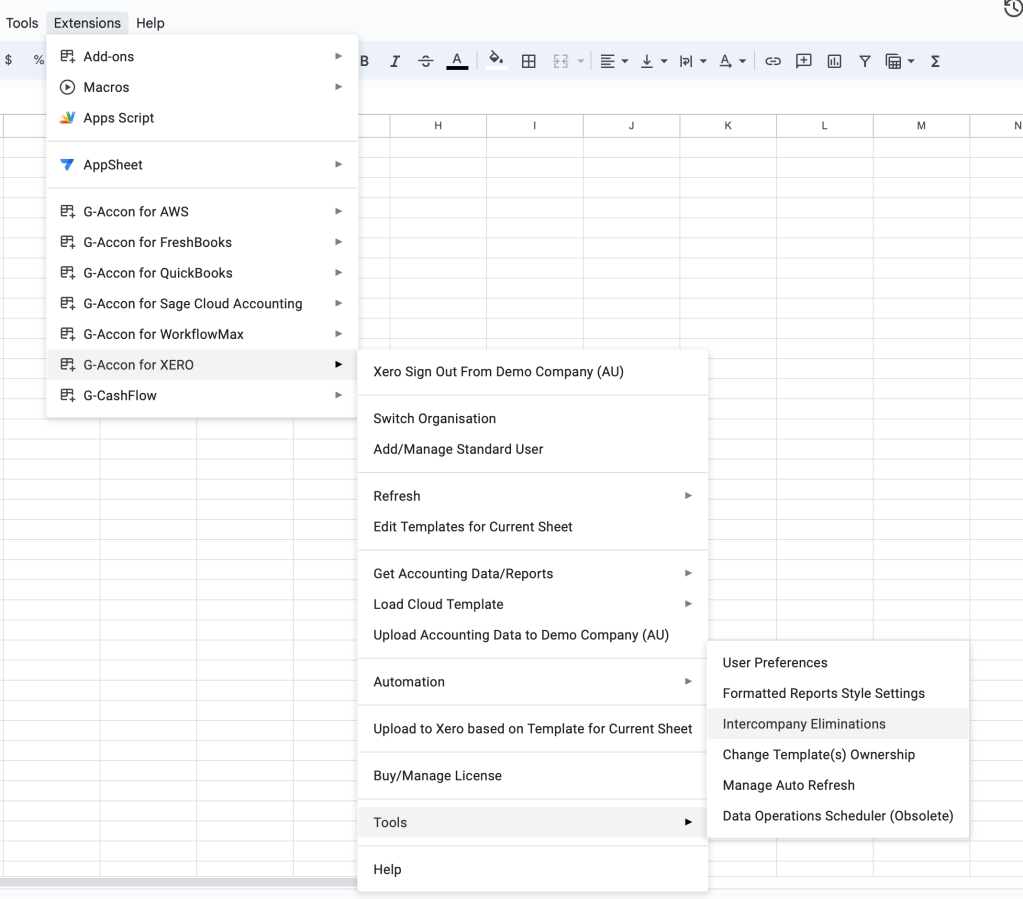

Elimination processes involve three major steps. It identifies intercompany transactions, selects appropriate elimination methods, and records journal entries. To start, connect your Xero account to G-Accon. Then, enable this integration via G-Accon for Xero → Tools → Intercompany Eliminations.

The steps for setting up intercompany elimination sets are easy. These include tweaking some parameters according to your needs. Here’s how to do it:

For detailed guidance, visit Intercompany Eliminations notes on the G-Accon Help Centre. You can also watch a step-by-step explanation of the Xero Consolidated Reports with Intercompany Eliminations.

See how G-Accon transforms Xero’s financial workflows with reporting personalization. With G-Accon reporting, you control the company’s financial data. Whether you need overall or in-detailed insights, there’s an option for you. Here’s the Consolidated Xero Reports with Intercompany Eliminations catalog:

These give you a snapshot of your business’s overall financial health:

Tune in to ground-level reporting, useful for in-depth analysis:

Get the most out of your financial reports. Here are a few quick tips:

To get the complete list of reports, go to Consolidated Xero Reports.

Simplify your financial reporting. Adopting these elimination processes gives your company valuable insights into financial health.

Unlike other tools, G-Accon automates and simplifies intercompany eliminations, ensuring results with

Explore G-Accon’s customizable features. Try G-Accon for Xero today with a free trial tailored to your business needs.

Get in touch with our support team by emailing us your suggestions at support@accon.services.

This is financial clarity made easy. This is G-Accon.

Since earning the 2018 Emerging App Partner of the Year, G-Accon remains a must-have for financial advisors. Backed up by Xero executives and experts, it’s time to join the Two-Way Wave movement by G-Accon.

Ready to experience the benefits of hassle-free data synchronization that many are already speaking of? Anticipation is over. This article will explain why G-Accon for Xero and Google Sheets is a must-have for all financial pros.

Ever wish to have your Xero data updated on Google Sheets without fear of human error? It’s upgrade season. Let G-Accon for Xero tackle your organization's data analysis needs. Here’s how.

More than features, G-Accon offers easy accounting solutions that fit existing workflows. Transform your financial operations with G-Accon for Xero. Discover what an impact we deliver.

Changing the Xero marketplace starts with happy accounting and bookkeeping businesses. How? Check out these G-Accon statistics highlighting robustness and scalability:

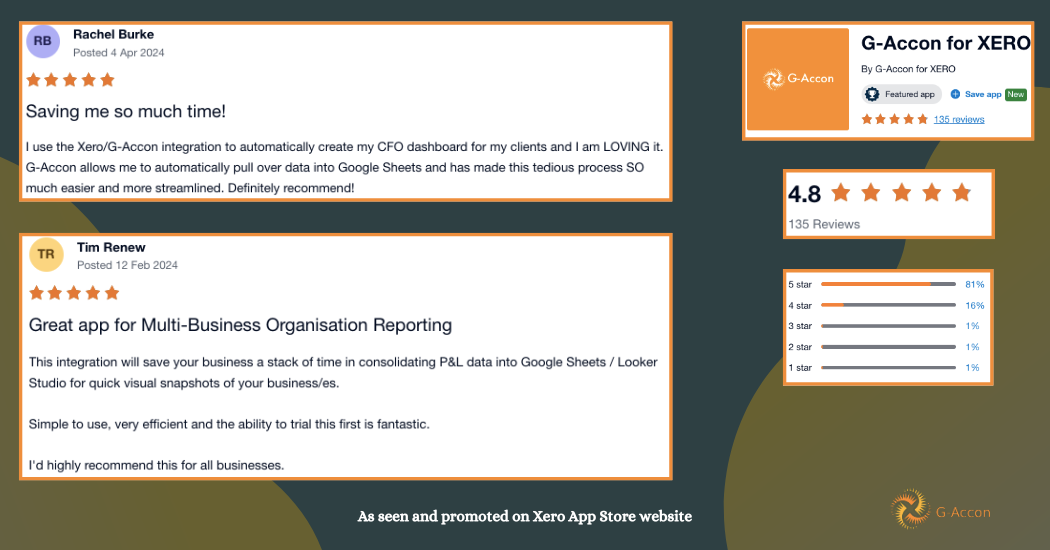

Minimizing tech headaches, G-Accon stands apart from other apps with limited functionality. What to hear more about our high satisfaction levels among the Xero community? Look at our most recent reviews, or log in to leave one.

Compared to competitors, G-Accon for Xero empowers you to get more doing less. Say yes to data management made simple. Propel your business with data-driven decision-making, among other benefits. Adopt an integration delivering on all these fronts:

Up-to-date data will set your financial team up for success. Supercharge rapid response to dynamic business environments.

Automating workflows redirects your business efforts to more strategic tasks. Routine tasks are be put aside to focus on business growth.

Improved decision-making is at hand. With comprehensive financial reports, you get valuable insights. What’s more, you ensure data compliance of your financial data.

G-Accon’s UI is accessible to all. Teams won’t need extensive training regardless of their tech expertise. Welcome accelerated integration into daily operations.

Whether a small business or a large enterprise, learn to take control of your finances by

With a solid approach and many advantages, G-Accon is the featured tool for any Xero user looking to optimize their financial processes. A competitive edge hard to overlook.

G-Accon for Xero guarantees enhanced data management tasks. Embrace financial management made easy. Head to the Xero App Store to connect Xero with Google Sheets for free.

Why wait? Try G-Accon for Xero today and take control of your business financial ops.

Eager to share feedback? Our support team wants to hear from you. Email your suggestions to support@accon.services.

This is financial clarity made easy. This is G-Accon.

Maintaining steady accuracy across multiple financial reports can feel like an uphill battle. Traditional consolidating reports also means fighting complexity and compliance. These will only take you so far. Add juggling business data between different platforms to the mix, and you have the potential for financial data-led mayhem.

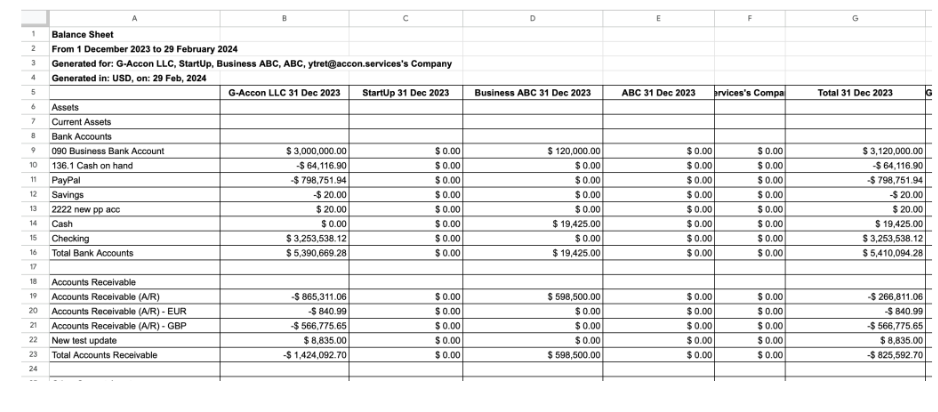

This is your call to access actionable input on your financial data with a unified reporting view. Gain control over your business's financial landscape with G-Accon Consolidated Reports: an all-in-one consolidation reporting suite with a complete view of a corporate group's financial performance. Investors, creditors, and stakeholders can use consolidated reports to optimize financial dynamics and focus on strategic financial decision-making.

Most of the time, financial professionals weather the demanding, complex finance landscape with ease. But as corporate needs evolve, so does the importance of meeting new financial requirements. Don’t let inaccurate reporting slow you down and trap you in poor reporting performance.

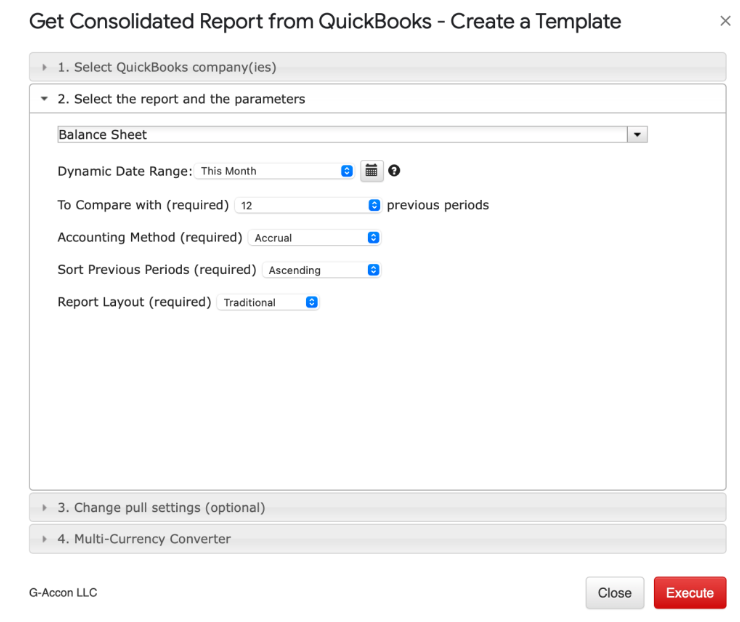

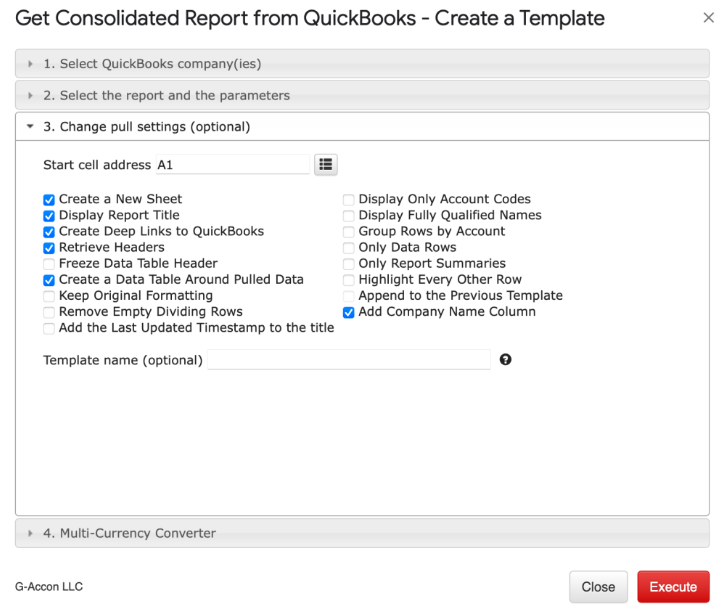

G-Accon Consolidated Reports for QuickBooks in Google Sheets comes to your rescue with an army of reports enhancing efficiency across the board. At its core, it offers streamlined consolidation of financial reports from various sources, including QuickBooks, into a single framework.

By consolidating reports, financial teams eliminate the need for cross-referencing multiple documents, leading to faster report generation. Be aware this efficiency does not come at the expense of detail. G-Accon’s automation processes are tailored to each business's needs and provide customized insights. Need more reasons? Just get a grasp of these time-saving features:

Opting for G-Accon’s QuickBooks integration for consolidated reporting means using all-embracing automated reports to simplify your compliance in financial consolidation and handling intercompany transactions with high precision. Curious to know more about these report’s capabilities? Let's examine each of them.

G-Accon's consolidated reporting for QuickBooks users caters to corporations' high-demanding accounting needs. To balance overall and detailed insights into individual entities, enjoy a dual reporting approach with two categories, each serving distinct strategic functions. Experience this combined formula for unmatched financial mastery.

For a comprehensive financial snapshot, take advantage of our overview consolidated reports, critical to reveal trends. These reports are designed to gain a deeper understanding of the business's overall financial health and include:

Enter company-specific insights with high-detailed analysis with the entity-level performance reports. Find precision reporting for your business with:

Take advantage of this competitive add-on. Make every business decision an opportunity to maximize reporting potential and navigate your business financial journey with great confidence.

Watch our quick video tutorial on how to generate new Consolidated Reports.

G-Accon not only addresses the common pain points faced by finance professionals but also leverages technology to empower businesses with clarity and strategic insights. With these features, you can transform your approach to financial management.

Select and customize reports to focus on your business strategy. Learn to access actionable insights, facilitating more informed decisions:

This reporting selection supports your business and financial stability by reducing financial consolidation times and complexities.

Propel data accuracy on your reports, reducing the risk of errors and enhancing trust in your financial data. When adapting attributes, you aid your data strategy in categorizing and analyzing financial data more efficiently. There are required and optional attributes with the ability to set up your data with:

Don’t wait; try this integration today to determine its many benefits.

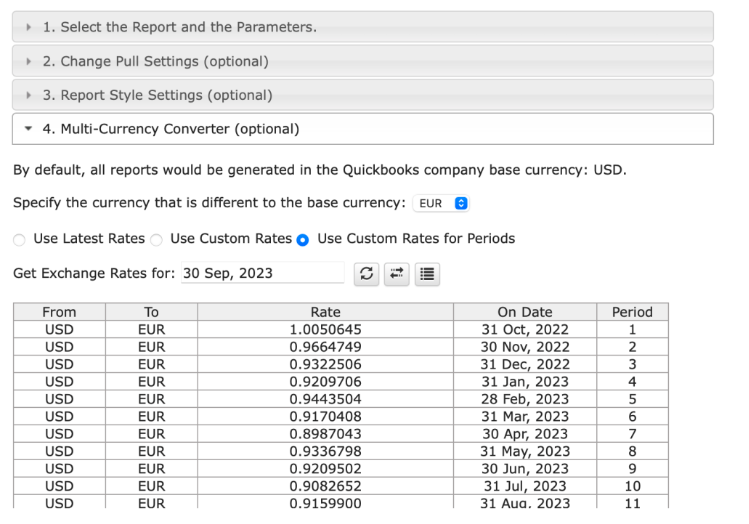

Handling multi-currency transactions is essential for businesses operating in the global market. This integration will save valuable time. Automate conversions and consolidation of multi-currency transactions and invest this precious time in other decisive operations. Benefit from generating custom multi-currency reporting featuring:

Reduce the time spent on data entry and consolidation, allowing more room for compliance. With automated consolidation, you get up-to-date data outflow, simplifying the compliance process. Automated data refreshes ensure ongoing data gathering reliability. Refer to the “Create Workflow” documentation here for more specific details.

By integrating these four key features into your financial reporting processes, G-Accon aims to leverage your business technology to empower your growth with strategic insights.

This set of features presents a solution that caters to the changing financial needs of modern accounting practices. Incorporating this consolidated reporting with G-Accon can evaporate complexity and clarify your strategic decisions with a unified data management approach.

Don’t let manual consolidations drain your productivity and stop your struggle to maintain accuracy across multiple reports with our consolidated reports for QuickBooks solution. Embrace financial mastery with:

Try G-Accon today to drive targeted financial management improvements and foster the growth of your business.

Email us at support@accon.services. Your contributions are highly valued as we strive to improve our services for users.

This is financial clarity made easy. This is G-Accon.

We're excited to announce our "Mastering Accounting Automation With G-Accon's Custom Xero and QuickBooks Reports and Upgraded UI" webinar. During our time together, we got to dig up how to:

This exclusive session, hosted by Sonia Yazdi, helps you to leverage our new User Interface to pull raw data, generate custom Xero and QuickBooks reports, automate processes, and more.

Let’s dive into our webinar’s highlights.

G-Accon’s enhanced data features released for Xero and QuickBooks provide accountants with a simplified user interface for streamlined data access. This new look helps accounting professionals to improve businesses’ financial reporting reliability.

For G-Accon for Xero users, this intuitive upgrade is available under Extensions > G-Accon for Xero > Get Accounting Data/Reports > Get Data to access a variety of data types, including

This revamp will also benefit our G-Accon for QuickBooks users. To access these options, click Extensions > G-Accon for QuickBooks > Get Accounting Data/Reports > Get Accounting Data.

Both implementations have beneficial features in common, such as

Our recorded session covered these upgraded data integrations, guiding you to reduce manual data entry and gain superior financial reporting insights.

With our Xero’s Custom Reports upgrade, G-Accon strengthens users' abilities to push forward enhanced financial reporting and analysis capabilities. These reports deliver a granular outlook of financial obligations and assets, facilitating sophisticated payables and receivables management and strategic planning of cash flows. Let’s briefly overview some of our featured reports.

This report delivers insights into aged payables using the customer’s currency. It’s particularly useful for businesses involved in international transactions and multiple currencies. Like the rest of our extensions, follow these steps to generate your report: check G-Accon for Xero > Reports > Standard Reports > Aged Payables Detail in the Customer Currency.

Users benefit from various adjustments when using this report, including

This reporting capability facilitates monitoring compliance with budgetary adherence while pinpointing areas with discrepancies. It contrasts planned budgets with actual expenses, sorted by tracking categories. Following our other tools' procedures, head to G-Accon for Xero > Reports > Standard Reports > Budget Variance by Tracking Category to create yours.

Our webinar discusses these tools to improve reporting customization and streamlined data handling via G-Accon for Xero.

Find the complete list of Xero reports here:

A major breakthrough for Quickbooks users, G-Accon's Cash Transactions Reports and Project Profitability Summary assist your business's financials in obtaining data-driven insights.

The former boosts reporting efficiency by directly linking to Google Sheets. Generate Profit and Loss reports with a comparison feature, which enables a side-by-side analysis of different classes or categories. Customizable for your business needs, it ensures precise transaction tracking. It's the accountant's go-to tool for accurate cash flow insights, which enable well-informed decisions.

With our Project Profitability Summary, reporting offers clear profitability insights. This feature will allow you to gain critical profitability insights for strategic business moves. It cements a better understanding of financial trends based on historical performance monitoring.

Meet and master our new Automatic Refresh solution. This automation feature turns your manual tasks into a coordinated system. It helps users organize all their workflows and automate their business processes, including refreshing queries/reports, uploading data, setting up alerts, creating backups, and using webhooks.

G-Accon’s webhooks feature automates data processes between the Google Sheets Web App and your accounting software. Its functionality supports the following attributes. Our webhooks demo explains how to implement Google Sheets with G-Accon Webhooks. It starts with creating web apps using Google Apps Script, focusing on the "doGet" function.

G-Accon has introduced a user interface feature called the “Sticky Floating Side Menu & Categories with Icons.” This design element is commonly found on websites and applications and can be dissected into the following key components:

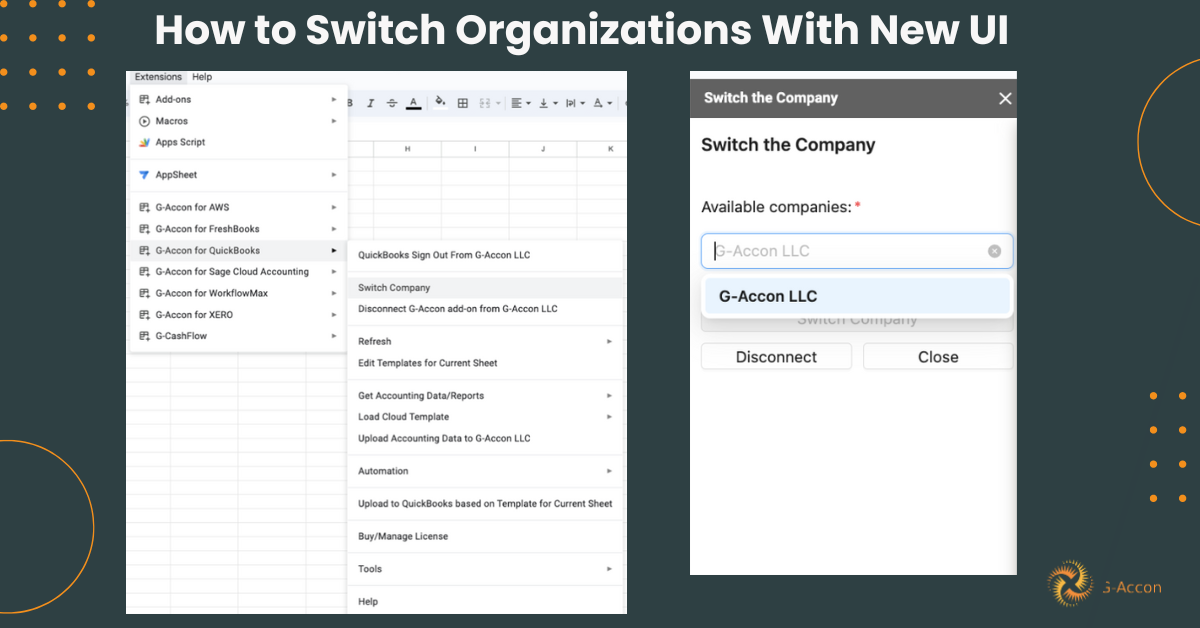

G-Accon helps you support more than one organization in Xero or QuickBooks. If you need to set up reports and workflows per organization, learn to switch between entities with us.

When joining our session, you’ll have the opportunity to get to know the Load Cloud Template module, which includes the following library and features:

Join our demonstration on how to make the most of your data by learning how to set up Default Values by using two distinct features:

This integration will enable you to select and manipulate the required attributes according to your business preferences to finely tune your reporting capabilities. Among these alternatives, we find:

From personalized accounting data retrieval to unmatched reporting capabilities, you have nothing to lose but lots to win. Make your decision today and choose financial analysis precision and boosted collaboration functionalities with:

By the end of the webinar, you’ll leave with valuable insights and practical tips on enhancing your reporting process and managing data transactions efficiently. Whether you’re an expert accounting professional or a business owner managing your accounts, this recording is designed to ease your financial data management.

Take this opportunity to elevate your financial strategy with G-Accon's solutions. Watch our complete webinar here:

Accessing seamless financial data management starts with one step. Try our G-Accon demo today to obtain up-to-date data-driven insights.

Feeling generous? Share your bright ideas and suggestions via email at support@accon.services.

This is financial clarity made easy. This is G-Accon.

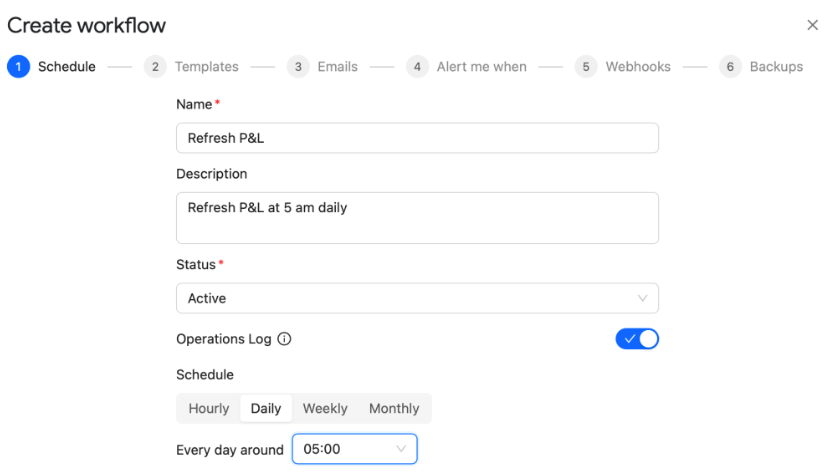

Meet our new Automatic Refresh solution, where manual tasks vanish, replaced by a symphony of automated workflows to refine your operational rhythm. This automation feature transforms your operational tempo, turning your manual tasks into a coordinated system. Here, reducing workload becomes a strategy to boost your clients’ satisfaction and an opportunity for growth.

G-Accon’s Automatic Workflows help users organize all their workflows within the Google spreadsheet more efficiently and automate their business processes, including refreshing queries/reports, uploading data, sending emails, setting up alerts, creating backups, and using webhooks.

Let’s have an overview of how to tailor workflows to your requirements, deploy personalized templates, and precisely manage schedules for various tasks.

Having automated workflows reduces the potential for human error. This strategic approach allows businesses to maintain a competitive edge in their industry.

Follow these steps to activate this feature:

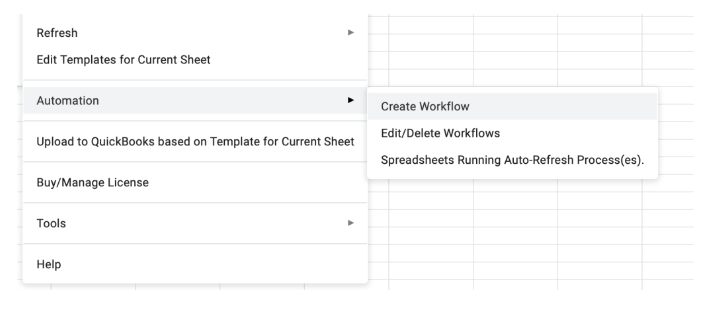

1. Go to the G-Accon menu option Automation > Create Workflow, as the image shows.

2. It’s time to specify the workflow's name and provide a description. For example, Name: “Refresh P&L” – Description: “Refresh P&L at 5 am daily”.

3. Then, choose between “Active” or “Not Active” statuses. If the workflow is not ready for execution, set the status to “Not Active”.

4. Finally, keep the Operations Log “On” to enable the log to view a record of all processes.

Customizing templates grants you access to personalized financial insights catering to your business needs. Now, you can add your desired templates by following this route:

Scheduling automated data refreshes ensures an ongoing information flow. Your final stage is to set up your schedule this way:

Automating financial reports and data entry in Google Sheets with G-Accon streamlines accounting processes, ensuring up-to-the-minute accuracy. This feature will allow your business to obtain a broader data-driven perception to fuel strategic financial management.

Watch our video explanation to learn how to set up this type of G-Accon's automations in Xero.

G-Accon’s enhanced data features for Xero offer accountants a new look and streamlined access. This upgrade is vital for professionals aiming to optimize workflows and improve reporting reliability.

This refresh for Xero users introduces an updated interface for all raw data downloads. This revamp is making data retrieval more intuitive. These options are available under Extensions > G-Accon for Xero > Get Accounting Data/Reports > Get Data to access a variety of data types, including

Here's how to get Accounting Data from Xero:

Designing templates simplifies the process of gathering, analyzing, and reporting financial information. Following these steps, let’s review how to implement this time-saving approach.

“Change Pull Settings” is a set of operations that can be executed to modify the data retrieval parameters. These operations include:

To activate these changes, specify the start cell (E.g., A11) and enter the template name in the designated field, such as “Template Name #1”. Click the “Execute” button to initiate the process, populating the report directly into the Google Sheet.

Choosing the filtering fields enables you to filter data based on the selected criteria:

Using the “Order Results By” option allows you to order your result by field in the Descending/Ascending order.

Our latest update for Xero, with its new look and improved data functionalities, offers unparalleled benefits. Professionals can significantly reduce manual data entry and increase data accuracy while leveraging technology for strategic advantage.

Harness your business's financial performance with two of our features, exclusive for G-Accon for QuickBooks, that have just been released. These will provide you with data-driven insights essential for making informed decisions.

Budget Uploads is one of our latest additions to boost budgeting efficiency. It allows the creation, editing, and removal of overall budgets for a specific year, categorizing budgets by classes and locations and seamlessly importing them from Google Sheets to QuickBooks.

G-Accon LOOKUP() function for dashboards solution helps to build custom dashboards by retrieving values according to filters from the specific templates. The “Historical” report layouts are recommended to use.

When you choose to use our automated workflow solutions, you'll stay ahead of the competition by accessing:

Keep your customers informed with automated workflows and seamlessly secure your business data insights with a robust solution. Empower your business’ financial management processes, improve data collection accuracy, and save time.

Try G-Accon today and set your financial reporting apart by streamlining your processes with automated efficiency.

Got input? Let us know your feedback via email at support@accon.services.

This is financial clarity made easy. This is G-Accon.

Joining powerhouses like Xero and Sage Intacct, G-Accon has made it into G2's 2024 Best Accounting & Finance Software Products. Our software has secured a coveted 20th position among leading accounting solutions. Being the absolute front-runner of Google Workspace for Finance, this acknowledgment is a nod to our efforts to provide time-saving integrations for professionals across the financial industry.

Here’s an invitation to revisit one of our recent blog posts for a deeper dive into our latest achievements, detailed in the G2 Winter 2024 Reports. Uncover the whole story and the nuances of our recent success at G-Accon's Winter G2 Awards.

This Custom Accounting Reports upgrade significantly strengthens users' abilities to push forward financial reporting and analysis capabilities. These reports are a toolkit for businesses engaged in international transactions or those looking to segment their data for refined financial management.

An invaluable collection of reports, it delivers a granular outlook of financial obligations and assets. Specifically, it facilitates sophisticated payables and receivables management and strategic planning of cash flows and collections efforts. Let’s have an overview of how this suite works.

Note: you must be logged into Xero to use these features.

It provides users with comprehensive information about aged payables organized by contact groups. Also, it facilitates a more precise understanding and management of payables related to different contact groups or suppliers.

To generate the accounting report from Xero, select G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Payables Detail by Contact Groups.

When exported to Google Sheets via G-Accon for Xero, it offers customizable financial oversight by contact groups. You’ll benefit from having automatic data refreshes and extensive report customization.

This report delivers insights into aged payables using the customer’s currency, which is particularly useful for businesses involved in international transactions and multiple currencies.

Similar to the rest of our extensions, follow these steps to generate your report: Select G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Payables Detail in the Customer Currency.

Users can gain from various adjustments, including

These tools highlight benefits like improved customization, scheduled updates, and streamlined data handling via G-Accon for Xero.

Like the aged payables report, this report displays aged receivables in the customer’s currency. It enables better receivables management in a multi-currency context.

In line with our existing extensions, you can follow this route to generate your report: select G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Receivables Detail in the Customer Currency.

Key features include the "Change Pull Settings" for report customization, such as formatting options, data table creation, and linking directly to Xero. It also facilitates setting up automated data refreshes and notifications through workflows, offering great flexibility in your reporting.

This feature details outstanding receivables by customer or client groups or categories. Overall, it simplifies the management and organization of collection efforts to sustain a healthy cash flow. Businesses need to categorize their accounts receivable information for optimized receivables management.

As with our other extensions, choose G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Aged Receivables Detail by Contact Groups to use this feature.

This analysis contrasts planned budgets with actual expenses, sorted by tracking categories. It aids in monitoring compliance with budgetary adherence while pinpointing areas with discrepancies.

Following our other tools' procedure, head to G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Budget Variance by Tracking Category to create your report.

It compares budgeted amounts with actual expenditures, segmented by tracking categories. It supports an in-depth evaluation of budgetary performance across various business segments.

Consistent with our suite of extensions, access your report by going to G-Accon for Xero > Get Accounting Data/Reports > Custom Reports > Budget vs Actual by Tracking Category.

This integration enhances automated workflows and streamlines data management while ensuring current updates. Extensive customization options facilitate polished presentations and empower actionable financial insights.

A robust package through and through, these reports’ functionalities bolster the reporting and analytical features of G-Accon for Xero. They excel at equipping users with a set of tools for effective financial data management and comprehension.

Watch our latest video on new custom accounting reports for QuickBooks and Xero in our G-Accon Integration channel:

Find the complete list of G-Accon for Xero reports here

Sharpen your business's financial edge now and gain some data-driven insight with these two features only released for Quickbooks.

G-Accon's Cash Transactions Report for QuickBooks boosts reporting efficiency by directly linking to Google Sheets. Users can now generate Profit and Loss reports with a comparison feature, which enables a side-by-side analysis of different classes or categories. Readily customizable for your business needs, it’ll ensure precise transaction tracking. It's the accountant's tool for deep cash flow insights, driving smart, timely decisions.

The Project Profitability Summary reshapes reporting by offering clear profitability insights. It enables quick strategy shifts with solid data comparisons over time. Tailored to your reporting needs, you’ll gain critical profitability insights for strategic moves. This feature will allow your business to understand financial trends comprehensively, cementing more informed business decisions based on historical performance.

You can have the right insights with our versatile reporting solutions on cash transactions, project profitability summaries, aged receivables, and more. Stay ahead of the competition with

By harnessing the full potential of these integrated reports, accountants can implement business strategies that are agile and aligned with their financial goals.

Confide in our expertise by accessing G-Accon's software today. Let us continue providing you with the best financial automation solutions.

Try G-Accon today and learn how to set your financial reporting apart by streamlining your processes with automated efficiency.

Any questions? Let us know your suggestions by shooting an email to support@accon.services.

This is financial clarity made easy. This is G-Accon.

Throughout the last year, we continued working to bring to life our vision of simplifying financial and accounting automation in Google Sheets. In this sense, G-Accon's steady growth and joint success wouldn’t have been possible without you. Your feedback and engagement have also served as a cornerstone in steering our products’ course.

This article overviews the most significant accolades, annual stats, and popular product releases and spotlights our users' satisfaction. From prominent awards to expanding our user base and product offerings, let's jump into these highlights about the G-Accon community.

Based on G2’s rating system, contrasted data, and customer reviews, G-Accon was ranked #1 in several categories across several Financial Reporting categories for G2 winter's reports, including Best Estimated ROI, Best Results Mid-Market, Fastest Implementation, and Most Implementable Mid-Market for Winter 2024. Our solution was awarded an impressive 25 badges in total.

The results speak for themselves. G2’s stats revealed a champion Mid-Market Implementation score. Compared to the category’s average of 2 months and a half, implementing G-Accon’s solutions takes our users less than seven days. Find out more about G-Accon’s winning features like this one, which we’ve covered in our end-of-year G2 awards article.

Also last year, AccountingToday released a curated list with over 40+ apps –informed by expert voices in the industry– featuring G-Accon as the go-to tool for accountants. Shannon Weinstein, president of fractional CFO service Keep What You Earn Co., chose G-Accon due to our hassle-free integration between Google Sheets and accounting software like Xero and QuickBooks. He also commended our seamless automation functionality, which enhanced his QBO reporting.

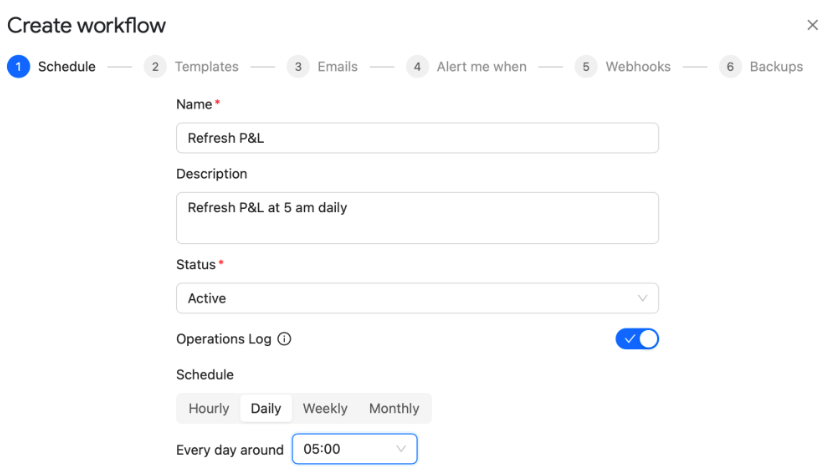

Let’s discuss statistics! The year 2023 also saw G-Accon delving into its reach. Overall, our QuickBooks user base surged by 55%. Moreover, over 4,000 new businesses started using G-Accon for QuickBooks in the QuickBooks App Store alone. This integration enabled these businesses to automate their reporting and bulk data exports and imports. These functionalities ultimately have had a significant impact on their operational efficiency and data management.

Similarly, Xero's user base reliance on our services surged by 41% over the year. Besides, our community's voice grew louder, with over 116 reviews on the QuickBooks App Store, 128 on Xero App Store, and 97 on G2. These participations have promoted widespread recognition and satisfaction with our offerings.

We also developed and powered two new additions to the Google Workspace Marketplace: G-CashFlow and G-Accon for Sage Cloud Accounting. The former is a 3-way cash flow forecast, and the latter builds tailored reports and dashboards, automatically handling Sage data directly from Google Sheets. These implementations reflect our dedication to enhancing our products’ capabilities while meeting the diverse needs of our users.

Staying ahead of market trends has always been at the heart of G-Accon's mission. As a result, 2023 was a year of game-changing releases. We deployed over 200 new features and reports, focusing on customizing and automating financial reporting.

Among the most popular new features launched in 2023 were

All these features help to make a difference in our customers’ operational efficiency by simplifying financial reporting. It’s our commitment to continue providing users with advanced tools for data-driven analysis and decision-making.

Considering how G-Accon continued transforming its clients’ financial reporting and analysis, 2023 echoed user satisfaction in all our review platforms. Here’s what our customers are saying about us:

At G-Accon, continuous improvement is more than just a goal; it's a core part of our culture. We believe there is always room for growth and improvement, and we’re working towards improving our solutions daily.

For us, 2024 is not just another year; it's an opportunity to make a bigger impact and continue providing you with the best financial automation solutions. We’re ready for the challenge and hope you’ll continue supporting us in your automation journey.

Also, thank you for being a part of G-Accon's story. We’re grateful for your continued trust and are excited to share future updates with you. Here's to a successful and innovative 2024!

Are you ready to start fresh in 2024? Try G-Accon today and let our integrations take care of the numbers so you can focus on what really matters: your new beginnings.

Any questions? Let us know your suggestions by shooting an email to support@accon.services.

This is financial clarity made easy. This is G-Accon.

Since 2017, we’ve been a leading cloud-based application that integrates Google Sheets with various Cloud accounting software. Over 17,000 businesses in more than 60 different countries already trust G-Accon to assist them with their financial data.

At G-Accon, we are passionate about simplifying data-driven decision-making without compromising. That’s why G-Accon has recently been named one of the Top Accounting Apps for 2023 by Accounting Today. Thanks to our partnership work, we also received the Xero Emerging App Partner of the Year Award in 2018.

Because we’re next-level experts at facilitating seamless automation, let’s determine how accurate financial reporting and analysis shouldn’t be a dilemma. In this blog, you’ll find an introduction to what the KPI Dashboard release is plus its features and implementation. It’ll be followed by a comprehensive guide to its customization with a final section addressing the most frequently asked questions.

Only a few weeks ago, we introduced the Business Overview Reports feature. Now, the newly implemented built-in package, the KPI Dashboards, comes in to boost your reporting and designing. These are a series of pre-designed templates to automate and customize your data to make more informed decisions.

G-Accon's KPI Dashboards, integrated into the Business Overview Reports, make this vision a reality. Let's embark on a step-by-step journey to unlock the full potential of this revolutionary tool.

If you’re interested in using our KPI dashboards, simply download the package from the following link. You can also email support@accon.services if you have any questions.

The first step in using the KPI reports and graphs design dashboard is to make a copy of the file. Because, at first, you’ll get a view-only file. Once you’ve created your usable version of the dashboard, begin with the data contained within our demo file, or “Dummy Data”.

Now comes the fun part. You must pull and replace this data with your client data. Take a look at our four recommendations on how to successfully run your new templates:

1. Load the Cloud Templates: Go to G-Accon Extension for QuickBooks, select Load Cloud Template, and then select the G-Accon Cloud template Library. Eight reports await your exploration.

2. Execute and Update all the Reports: These need to be downloaded, applied in a certain order, and executed. Start with the Profit and Loss Report. The next step that you will do is follow the same procedure for the rest of the eight tabs. Execute them without modifications, maintaining the same specified order for all reports.

3. Customizing Date Ranges: Seamlessly adjust the set-up date ranges for all reports at once within the Dates tab. A small yet powerful feature for a clearer view of client data.

Important: Note that the last tab, the Total Data tab, is very important. This query with formulas allows us to build the dashboard for you in tab number two. Please, don’t delete or modify this tab as it’s essential to make sure that your dashboard’s data is accurate.

4. Dashboard Building: Move to the second tab, where formulas come to life. Apply the templates and your fully functional dashboard will be ready, requiring only a logo change. In tab number one, the company profile and details will automatically update. The only task you have to change is the company logo to your respective logo or client logo.

Your next step in customizing this dashboard is automation. This is the key part of the process. To do that, follow these three simple suggestions:

For those looking for some extra customization, we recommend hiding sheets that don't need to be displayed to clients, like the summary sheets. To do this, go to the Dashboard tabs and review your tabs at the bottom, such as Profit and Loss. In this context, we advise to focus on tabs containing detailed reports to be shown to clients

In a nutshell, our pre-designed templates feature default styles, fonts, and layouts but these can be easily customized to meet your customers' expectations. This set of reports will be a valuable tool for easy-to-manage key financial metrics management to help you make informed decisions.

For a more in-depth demonstration of these steps, we invite you to watch our 10-minute video explanation in which our team member Sonia Yazdi illustrates the package implementation.

Recently, we delivered an insightful webinar with a Live Q&A, where Andrew Forte, a certified G-Accon partner and the mind behind DataNow.Guru, shared his takeaways when implementing the KPI Dashboards in his business.

His G-Accon journey started with “inventory management, pulling live inventory data from Xero into Google Sheets, and updating every hour,” he said. This small need led him to “discover its incredible potential,” he confirmed.

DataNow.Guru’s most popular service is building out G-Accon reports for fractional CFO firms. According to him:

"I think that not a single day has passed in the last seven years when I haven't used G-Accon. The possibilities with G-Accon and Sheets are almost unlimited. And I think that's the main benefit of G-Accon. I know a lot of CFOs out there struggle with whether they should use Fathom or Syft, or whether they should use any mainstream reporting software. However, you're never going to achieve the granularity that you can with G-Accon."

– Andrew Forte, Founder & CEO of DataNow.Guru.

During the webinar, he did a demonstration with different dashboards that are possible within G-Accon. Andrew showcased G-Accon's versatility, presenting diverse dashboards from simple one-page reports to detailed financial statements. Let’s have a look at his highlights.

Andrew emphasized G-Accon's “unparalleled granularity”. It allows you “to analyze and find specific details that matter to your business,” he mentioned. He also highlighted that “it enables you to see everything from your accounting system in a single spreadsheet, making it convenient for investors and business owners”.

His main insights on bringing dashboards to life with dynamic data were:

Listen to Andrew from DataNow.guru enumerating the benefits of using G-Accon as their daily tool for the past 7 years:

Without further ado, here you have the Q&A section from our KPI DashboardsDesign live webinar.

During our webinar, we gathered and answered your most pressing questions. Let's delve into the insights:

No. Currently, there are no plans for a NetSuite integration. G-Accon focuses on enhancing integration between Xero/QuickBooks and MS 365.

The recording is available on G-Accon's YouTube channel for comprehensive revisits. If you don’t want to miss all the highlights, watch the full webinar by clicking here.

Our emphasis is on integrating Xero/QuickBooks with MS 365 in the future.

The dashboard templates are readily available here.

Find templates in the "Cloud Template Library" by searching for "KPI". Specifically, there are 8 templates available to build the dashboards.

There are 5 KPI dashboard versions for QuickBooks users and one version for Xero users, accessible here.

For optimal mobile viewing, exporting the dashboard as a PDF is recommended.

While the Balance Sheet is a required report offering a summary, the Balance Sheet Report provides style options for client presentations.

Developers can reach out to support@accon.services for collaboration inquiries.

Overcome the 12-month limitation by creating multiple templates with different date ranges, as demonstrated here.

Yes. Find Budget vs Actual and Budget Variance reports under Custom Accounting Reports and Business Overview.

Pulling a Balance Sheet is conveniently done from the Get Accounting Data/Reports menu option. A detailed guide is available here.

Yes. G-Accon offers various reports like Sales Details, Sales by Customer, and Sales by Product and Services.

Adding tabs won't adversely affect the existing dashboard.

Not yet. G-Accon eventually will add the additional templates for both Accounts Receivable and Accounts Payable.

Join the Facebook G-Accon users group for community discussions. Join us here.

We suggest starting with the QuickStart guide and attending weekly webinars for a solid foundation.

While no specific KPI dashboards for multiple QBO companies exist, explore consolidation options in this tutorial.

As you know, when it comes to financial data, misrepresentations can lead to serious consequences. Understanding the importance of effectively utilizing real-time data through G-Accon will save efforts and expenses. G-Accon will lend a hand to help you manage your data and pull it effectively. It's live, in real-time, and as simple as it can get.

G-Accon's KPI Dashboards are the gateways to unlock improved financial insights. We aim to guide you through the seamless integration, customization, and practicality of these dashboards. By exploring our KPI templates and accessing G-Accon’s community and support resources, we’re sure to elevate your financial analytics game.

Stay tuned for more exciting sessions empowering your financial data. Until then, let G-Accon be your guide in the world of data mastery.

Any questions? Let us know your suggestions by shooting an email to support@accon.services.

This is financial clarity made easy. This is G-Accon.

Update: This feature is now available for Xero and QuickBooks users.

Having your financial tasks streamlined with insights into your company's performance and seamless team collaboration and accessibility. Too good to be true? Then, keep reading.

Whether you're a business owner or a finance professional, don’t ignore this feature. G-Accon’s latest software release, featuring Business Overview Reports, is an essential tool for your business's overall financial well-being.

In this express guide, we’ll explore what Business Overview Reports are, how to generate them, and how to design reports using the Report Style feature. By the end of this blog, you'll be well-equipped to reap the benefits of our latest release.

Join us to learn why mastering this game-changing feature is crucial for financial success.

Business Overview Reports offer a high-level view of your business's key financial metrics.

They cover major aspects such as revenue, expenses, profitability, and cash flow. With these reports, you’ll make well-informed decisions based on real-time dashboards and customized reports.

It also means time saved on manual data entry, better accuracy in financial records, and up-to-the-minute bank reconciliations. These reporting tools provide personalized insights into your financial metrics, elevating the value you’ll offer your clients.

Generating Business Overview Reports is a straightforward process. We’ll get you started with these easy steps.

It begins with signing in to G-Accon for QuickBooks (Or Xero).

Click "Get Accounting Data/Reports” to choose your required report. Here, you'll find the option to select "Business Overview Reports" from a dropdown list, which offers various report types that can be used later as reusable templates.

For instance, if you select the "Balance Sheet" option, you can select the parameters you want. So you can set the date range for your data manually or refresh it dynamically.

This choice gives you flexibility in determining the time frame for your financial insights, whether you prefer predefined values or specific custom dates.

When creating the Balance Sheet report, you must also select required attributes such as the number of periods to compare, the accounting method (accrual or cash), relevant accounts, locations, classes, and items.

These selections help tailor the report to your business's specific needs, ensuring you receive the insights that matter most.

Besides these essentials, you can enhance your reporting even more by exploring extra features. Our software offers optional features to customize the report's behavior further.

Among these options, you’ll find generating the report in a new Google Sheet, hiding grid lines for a cleaner look, displaying negative values in red, creating deep links to QuickBooks for easy navigation, and showing only whole numbers.

Isn’t it neat? But that’s not all.

To keep your reports well-organized, specify the template's name, such as "Balance Sheets for Organization ABC," in the "Template Name" field.

If you’re working with multiple reports, that'll be a significant time-saver.

Did you mention flexibility? We’ve got you covered.

One of the standout features of Business Overview Reports is its pre-designed templates with default styles, fonts, and layouts that are ready for use. Play with these aspects as you develop informative reports to meet your needs.

Go into detail with the Report Style feature. Explore and adjust each report section to perfection. Accommodate and tweak specific report elements such as titles, headers, and sub-section totals.

This level of in-depth customization allows you to create reports that voice your unique brand’s visual identity and messaging.

Using a different currency? No worries. If you need to generate reports in a specific currency, you can select the report’s currency and decide how to get exchange rates. Some options include using the latest rates and custom rates for specific dates. This ensures the versatility your reports need to remain relevant to your global audience.

Business Overview Reports are your window into the financial health of your business. They’re more than numbers. They're powerful tools for making informed decisions, planning for the future, and staying competitive.

Still hesitant? Here are our 5 reasons to try the Business Overview Reports feature today:

Take this opportunity to level up your game. Move forward toward financial clarity and success in the world of business.

And here’s a bonus for you. Master designing these reports and watch our business reports video tutorial.

In this video, we provide step-by-step guidance and best practices to ensure your reports are both instructional and eye-catching. Don't miss out on the benefits and watch the video now.

Go ahead. Put your newfound knowledge into action today. Harness with us the full potential of Business Overview Reports for your company's benefit:

Feel free to reach us at support@accon.services. Let us know about your doubts or constructive suggestions.

This is financial clarity made easy. This is G-Accon.

Update: this feature is now available for Xero users.

We are incredibly excited to announce the release of our new feature: Sticky Annotations. In response to feedback from our user community, we've integrated this feature into G-Accon for QuickBooks Google Sheets add-on, allowing you to make your spreadsheets and reports more personalized and versatile.

But it doesn't stop there. Annotations in G-Accon also enable you to customize your live reports with colors, headers, and more. This feature has just been released for G-Accon for QuickBooks and we're working hard to make it available for Xero users soon.

Here is a comprehensive guide on how you can use annotations to enhance your data and reports in G-Accon.

Annotations are extra notes, comments, formulas or other types of additional information that you can attach to your G-Accon reports and templates. You can use them to provide extra details, insights, or reminders related to specific data points or sections of your report.

We've designed our annotations feature to be user-friendly and intuitive. You can add annotations directly into your G-Accon reports and templates. They will be preserved even when the report or template is refreshed, meaning your important notes and insights will always remain visible.

Adding annotations and custom styling inside or outside reporting template

Adding formulas and custom formatting

The launch of Annotations takes G-Accon's functionality a step further, making your real-time QuickBooks and Xero reports in spreadsheets not only more dynamic and insightful, but also visually engaging and organized. We're excited to see how you'll use annotations and custom formatting to bring your data analysis to the next level.

Remember, Annotations are not just about adding notes, comments, and formulas to your reports, they're about making your data work for you. Whether you're adding valuable context, complex calculations, comments for your team, or applying a unique color scheme to your data, annotations ensure your personalized touch remains, even when your data is refreshed.

Watch a step-by-step video tutorial on how to use this feature.

We're confident that Annotations, complete with custom formatting, will be a game-changer for your data analysis and reporting. So start annotating and discover the power of personalized, context-rich, and aesthetically pleasing data analysis with G-Accon. Happy annotating!

Updated: watch the full recording available on our YouTube channel: https://youtu.be/FgTg-n_amPA

We are excited to invite you to a live webinar where we will be showcasing the powerful capabilities of G-Accon and Uncat in streamlining financial data management. Whether you are seeking efficient data importing, categorization, or reconciliation solutions, this webinar is a must-attend for optimizing your financial processes.

Reserve your spot today and join us on June 8 at 11 AM EST.

During the webinar, Brandon Bruce, Chief Cat Herder of Uncat, and Yelena Tretyakova, COO of G-Accon, will present a LIVE demo of G-Accon and Uncat powerful tools for managing your financial data.

In this segment of the webinar, we will explore the robust capabilities of G-Accon's 2-way sync functionality. Learn how to leverage this feature to maintain and clean your financial and non-financial data in Google Sheets, ensuring data accuracy and up-to-date records at all times. No more data discrepancies or outdated information - with G-Accon, your data management becomes a breeze.

In an era of digital transformation, automation is the key to increased efficiency. We will delve into how G-Accon enables users to generate custom reports and automate their downloads directly within Google Sheets. Say goodbye to the manual, time-consuming process of pulling data and creating reports from scratch.

G-Accon does more than just sync and automate; it also adds value to your reports. During the webinar, we will show you how to add notes, comments, and formulas to your reports in Google Sheets and keep them intact even after data refreshes. With G-Accon, your report annotations enhance your data insights without getting lost during updates.

We are thrilled to partner with Uncat for this webinar. Uncat is a game-changer in the way accountants and bookkeepers manage uncategorized transactions in QuickBooks and Xero. During the webinar, we will shed light on how Uncat can assist in tidying up these transactions, particularly during month-end close, allowing you to maintain organized books and focus on analysis rather than data cleanup.

By the end of the webinar, you will have an in-depth understanding of how to effectively use G-Accon and Uncat to optimize your accounting workflow. You'll walk away with valuable insights on maintaining clean financial data, automating and enhancing your reporting process, and managing uncategorized transactions efficiently.

We are looking forward to sharing these invaluable insights and practical tips with you during the webinar. No matter if you're an accounting professional or a business owner managing your own accounts, this session is designed to bring your financial data management to the next level.

Register today and join us on June 8 at 11 AM EST for an enlightening session on how to simplify and streamline your accounting processes with G-Accon and Uncat. We're looking forward to seeing you there!

G-Accon is a robust tool that bridges Google Sheets with QuickBooks and Xero, automating live reporting, consolidations, and bulk importing/editing of data straight from your spreadsheets. It turns your accounting operations into an efficient, streamlined process, making financial data analysis easier than ever.

Uncat syncs with QuickBooks and Xero and helps thousands of accountants and bookkeepers clean up uncategorized transactions with their clients for month-end close.

Join the Webinar to Explore these Powerful Tools!

Missed the webinar? Watch the full recording here: